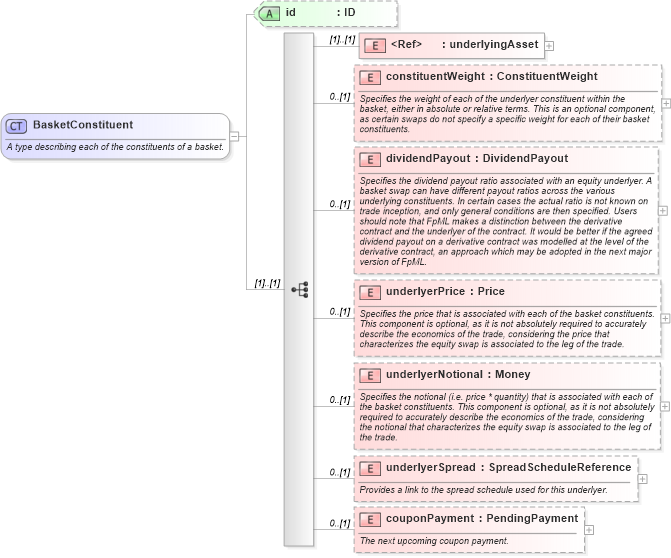

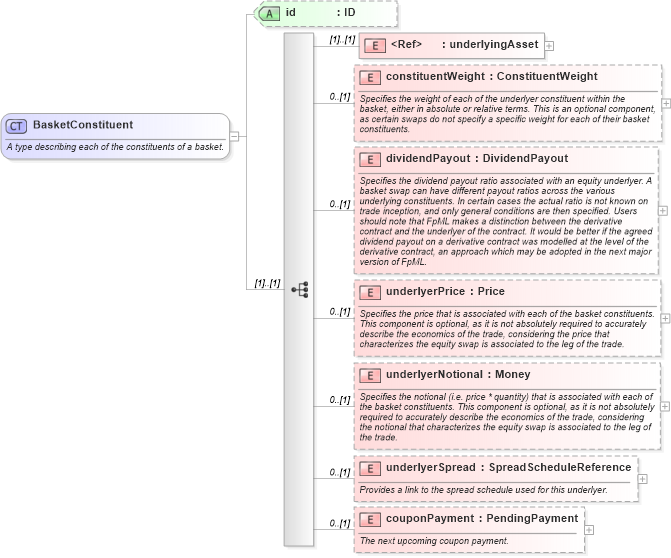

<xsd:complexType name="BasketConstituent">

<xsd:annotation>

<xsd:documentation xml:lang="en">A type describing each of the constituents of a basket.</xsd:documentation>

</xsd:annotation>

<xsd:sequence>

<xsd:element ref="underlyingAsset" />

<xsd:element name="constituentWeight" type="ConstituentWeight" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Specifies the weight of each of the underlyer constituent within the basket, either in absolute or relative terms. This is an optional component, as certain swaps do not specify a specific weight for each of their basket constituents.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="dividendPayout" type="DividendPayout" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Specifies the dividend payout ratio associated with an equity underlyer. A basket swap can have different payout ratios across the various underlying constituents. In certain cases the actual ratio is not known on trade inception, and only general conditions are then specified. Users should note that FpML makes a distinction between the derivative contract and the underlyer of the contract. It would be better if the agreed dividend payout on a derivative contract was modelled at the level of the derivative contract, an approach which may be adopted in the next major version of FpML.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="underlyerPrice" type="Price" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Specifies the price that is associated with each of the basket constituents. This component is optional, as it is not absolutely required to accurately describe the economics of the trade, considering the price that characterizes the equity swap is associated to the leg of the trade.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="underlyerNotional" type="Money" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Specifies the notional (i.e. price * quantity) that is associated with each of the basket constituents. This component is optional, as it is not absolutely required to accurately describe the economics of the trade, considering the notional that characterizes the equity swap is associated to the leg of the trade.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="underlyerSpread" type="SpreadScheduleReference" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Provides a link to the spread schedule used for this underlyer.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="couponPayment" type="PendingPayment" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">The next upcoming coupon payment.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

<xsd:attribute name="id" type="xsd:ID" use="optional" />

</xsd:complexType>

|