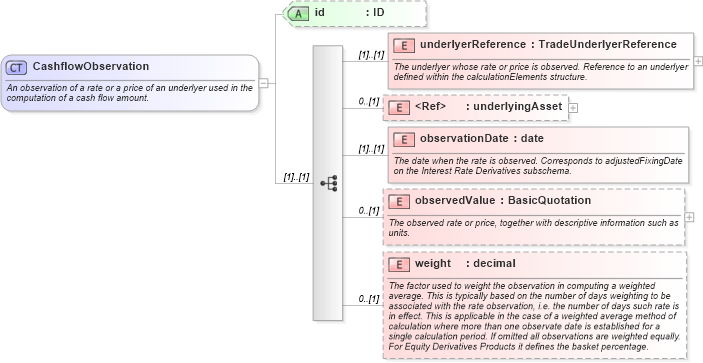

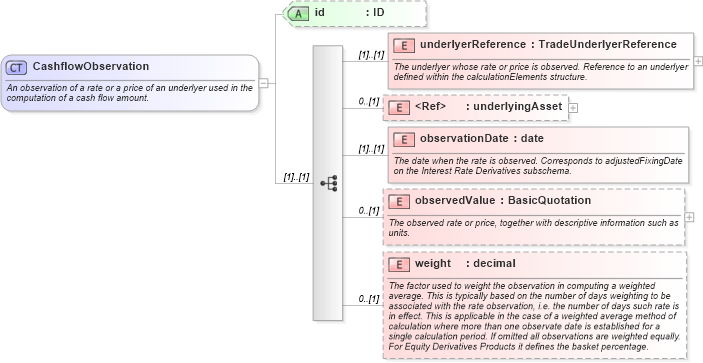

<xsd:complexType name="CashflowObservation">

<xsd:annotation>

<xsd:documentation xml:lang="en">An observation of a rate or a price of an underlyer used in the computation of a cash flow amount.</xsd:documentation>

</xsd:annotation>

<xsd:sequence>

<xsd:element name="underlyerReference" type="TradeUnderlyerReference">

<xsd:annotation>

<xsd:documentation xml:lang="en">The underlyer whose rate or price is observed. Reference to an underlyer defined within the calculationElements structure.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element ref="underlyingAsset" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">In cases where the underlying index is observed by observing the value of a specific security different from the index (typically a futures price), the specific security whose price was observed. For example, the underlying index might be NYMEX Crude Oil, and the underlying asset whose price is observed on a particular day might be CLU7. The index is specified via the underlyerReference, while the specific asset is specified via the underlyingAsset.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="observationDate" type="xsd:date">

<xsd:annotation>

<xsd:documentation xml:lang="en">The date when the rate is observed. Corresponds to adjustedFixingDate on the Interest Rate Derivatives subschema.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="observedValue" type="BasicQuotation" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">The observed rate or price, together with descriptive information such as units.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="weight" type="xsd:decimal" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">The factor used to weight the observation in computing a weighted average. This is typically based on the number of days weighting to be associated with the rate observation, i.e. the number of days such rate is in effect. This is applicable in the case of a weighted average method of calculation where more than one observate date is established for a single calculation period. If omitted all observations are weighted equally. For Equity Derivatives Products it defines the basket percentage.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

<xsd:attribute name="id" type="xsd:ID" use="optional" />

</xsd:complexType>

|