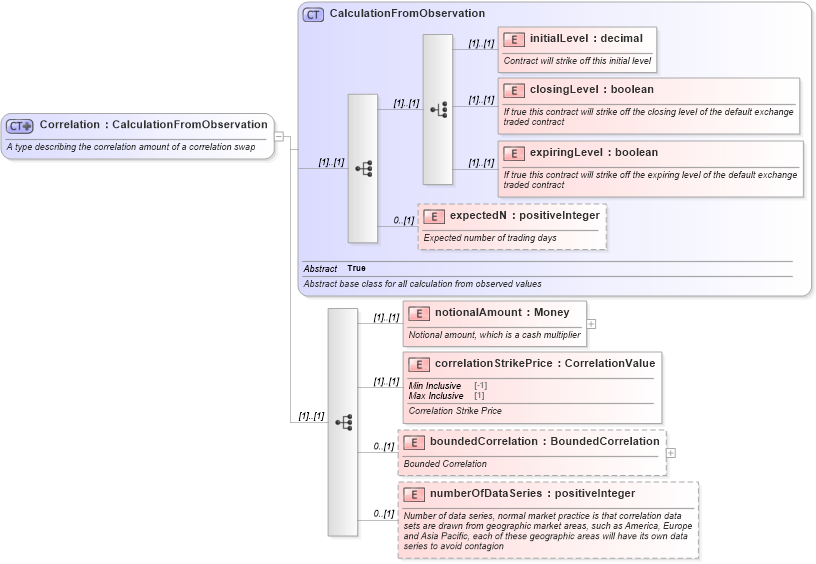

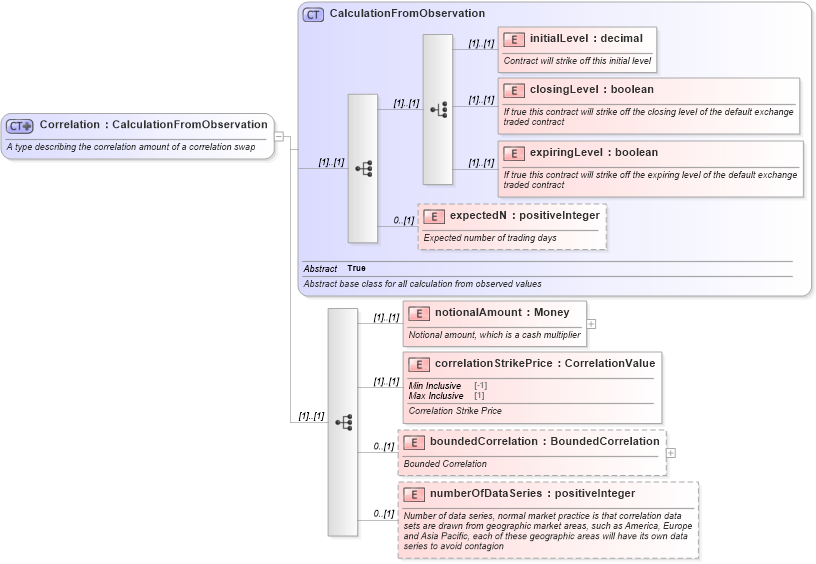

<xsd:complexType name="Correlation">

<xsd:annotation>

<xsd:documentation xml:lang="en">A type describing the correlation amount of a correlation swap</xsd:documentation>

</xsd:annotation>

<xsd:complexContent>

<xsd:extension base="CalculationFromObservation">

<xsd:sequence>

<xsd:element name="notionalAmount" type="Money">

<xsd:annotation>

<xsd:documentation xml:lang="en">Notional amount, which is a cash multiplier</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="correlationStrikePrice" type="CorrelationValue">

<xsd:annotation>

<xsd:documentation xml:lang="en">Correlation Strike Price</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="boundedCorrelation" type="BoundedCorrelation" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Bounded Correlation</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="numberOfDataSeries" type="xsd:positiveInteger" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Number of data series, normal market practice is that correlation data sets are drawn from geographic market areas, such as America, Europe and Asia Pacific, each of these geographic areas will have its own data series to avoid contagion</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

|