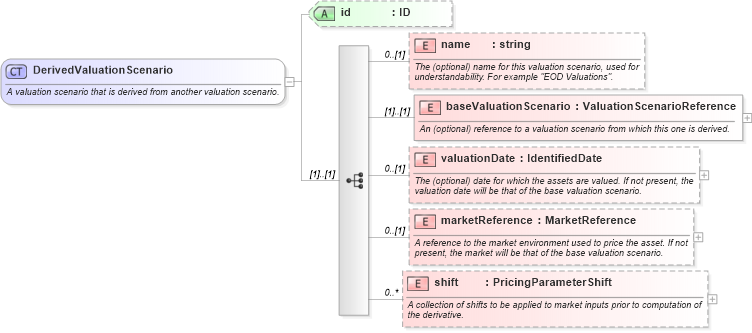

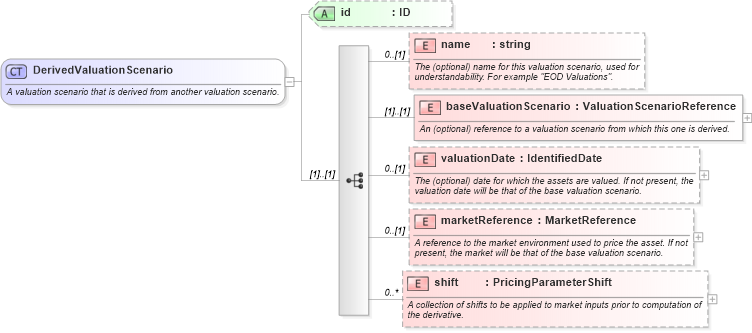

<xsd:complexType name="DerivedValuationScenario">

<xsd:annotation>

<xsd:documentation xml:lang="en">A valuation scenario that is derived from another valuation scenario.</xsd:documentation>

</xsd:annotation>

<xsd:sequence>

<xsd:element name="name" type="xsd:string" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">The (optional) name for this valuation scenario, used for understandability. For example "EOD Valuations".</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="baseValuationScenario" type="ValuationScenarioReference">

<xsd:annotation>

<xsd:documentation xml:lang="en">An (optional) reference to a valuation scenario from which this one is derived.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="valuationDate" type="IdentifiedDate" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">The (optional) date for which the assets are valued. If not present, the valuation date will be that of the base valuation scenario.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="marketReference" type="MarketReference" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">A reference to the market environment used to price the asset. If not present, the market will be that of the base valuation scenario.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="shift" type="PricingParameterShift" minOccurs="0" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">A collection of shifts to be applied to market inputs prior to computation of the derivative.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

<xsd:attribute name="id" type="xsd:ID" />

</xsd:complexType>

|