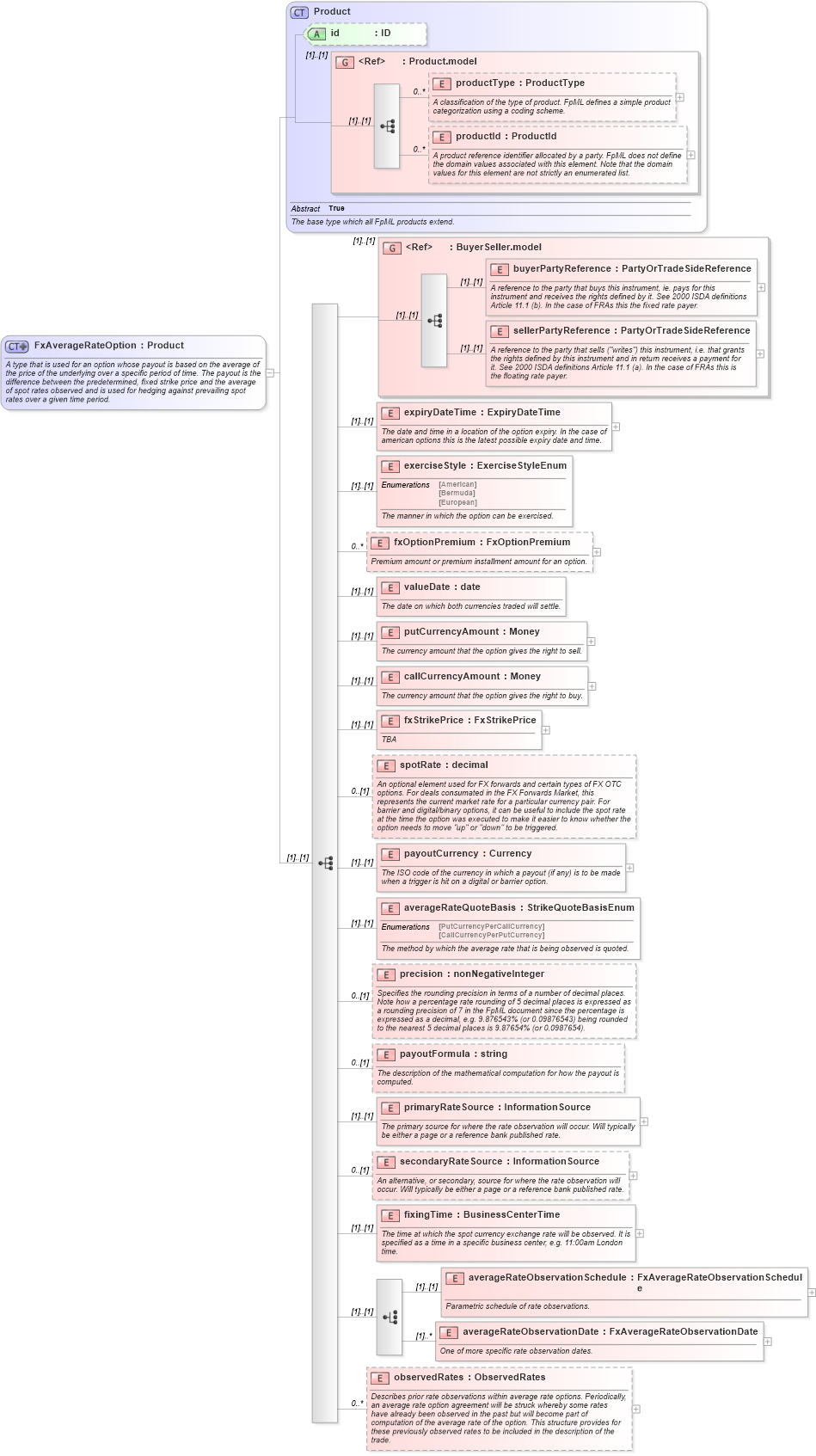

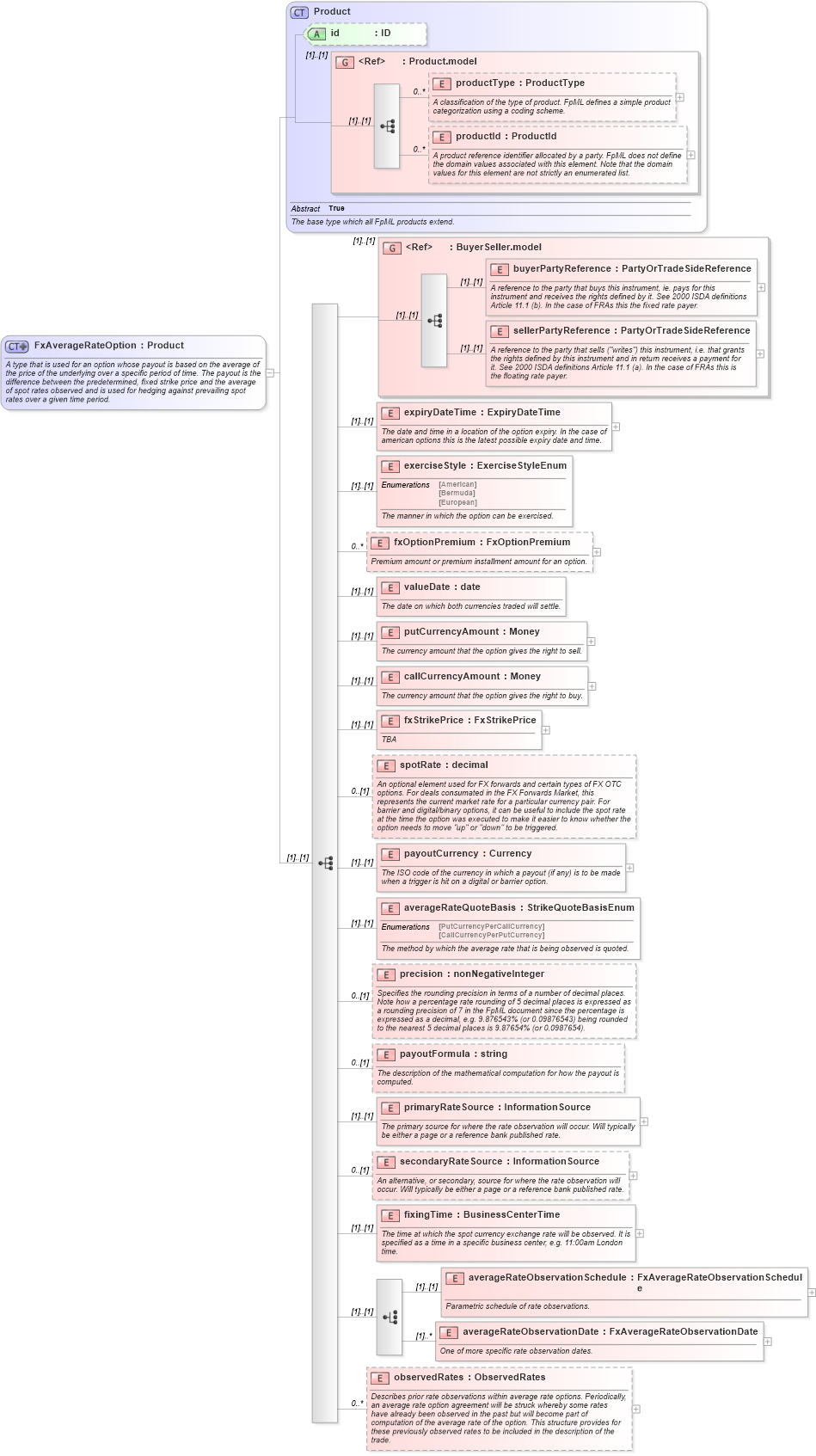

<xsd:complexType name="FxAverageRateOption">

<xsd:annotation>

<xsd:documentation xml:lang="en">A type that is used for an option whose payout is based on the average of the price of the underlying over a specific period of time. The payout is the difference between the predetermined, fixed strike price and the average of spot rates observed and is used for hedging against prevailing spot rates over a given time period.</xsd:documentation>

</xsd:annotation>

<xsd:complexContent>

<xsd:extension base="Product">

<xsd:sequence>

<xsd:group ref="BuyerSeller.model" />

<xsd:element name="expiryDateTime" type="ExpiryDateTime">

<xsd:annotation>

<xsd:documentation xml:lang="en">The date and time in a location of the option expiry. In the case of american options this is the latest possible expiry date and time.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="exerciseStyle" type="ExerciseStyleEnum">

<xsd:annotation>

<xsd:documentation xml:lang="en">The manner in which the option can be exercised.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="fxOptionPremium" type="FxOptionPremium" minOccurs="0" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">Premium amount or premium installment amount for an option.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="valueDate" type="xsd:date">

<xsd:annotation>

<xsd:documentation xml:lang="en">The date on which both currencies traded will settle.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="putCurrencyAmount" type="Money">

<xsd:annotation>

<xsd:documentation xml:lang="en">The currency amount that the option gives the right to sell.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="callCurrencyAmount" type="Money">

<xsd:annotation>

<xsd:documentation xml:lang="en">The currency amount that the option gives the right to buy.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="fxStrikePrice" type="FxStrikePrice">

<xsd:annotation>

<xsd:documentation xml:lang="en">TBA</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="spotRate" type="xsd:decimal" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">An optional element used for FX forwards and certain types of FX OTC options. For deals consumated in the FX Forwards Market, this represents the current market rate for a particular currency pair. For barrier and digital/binary options, it can be useful to include the spot rate at the time the option was executed to make it easier to know whether the option needs to move "up" or "down" to be triggered.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="payoutCurrency" type="Currency">

<xsd:annotation>

<xsd:documentation xml:lang="en">The ISO code of the currency in which a payout (if any) is to be made when a trigger is hit on a digital or barrier option.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="averageRateQuoteBasis" type="StrikeQuoteBasisEnum">

<xsd:annotation>

<xsd:documentation xml:lang="en">The method by which the average rate that is being observed is quoted.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="precision" type="xsd:nonNegativeInteger" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Specifies the rounding precision in terms of a number of decimal places. Note how a percentage rate rounding of 5 decimal places is expressed as a rounding precision of 7 in the FpML document since the percentage is expressed as a decimal, e.g. 9.876543% (or 0.09876543) being rounded to the nearest 5 decimal places is 9.87654% (or 0.0987654).</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="payoutFormula" type="xsd:string" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">The description of the mathematical computation for how the payout is computed.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="primaryRateSource" type="InformationSource">

<xsd:annotation>

<xsd:documentation xml:lang="en">The primary source for where the rate observation will occur. Will typically be either a page or a reference bank published rate.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="secondaryRateSource" type="InformationSource" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">An alternative, or secondary, source for where the rate observation will occur. Will typically be either a page or a reference bank published rate.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="fixingTime" type="BusinessCenterTime">

<xsd:annotation>

<xsd:documentation xml:lang="en">The time at which the spot currency exchange rate will be observed. It is specified as a time in a specific business center, e.g. 11:00am London time.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:choice>

<xsd:element name="averageRateObservationSchedule" type="FxAverageRateObservationSchedule">

<xsd:annotation>

<xsd:documentation xml:lang="en">Parametric schedule of rate observations.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="averageRateObservationDate" type="FxAverageRateObservationDate" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">One of more specific rate observation dates.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:choice>

<xsd:element name="observedRates" type="ObservedRates" minOccurs="0" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">Describes prior rate observations within average rate options. Periodically, an average rate option agreement will be struck whereby some rates have already been observed in the past but will become part of computation of the average rate of the option. This structure provides for these previously observed rates to be included in the description of the trade.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

|