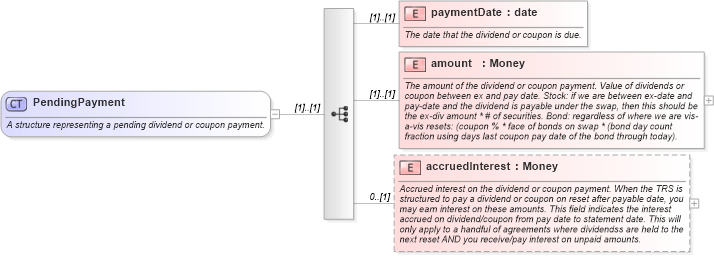

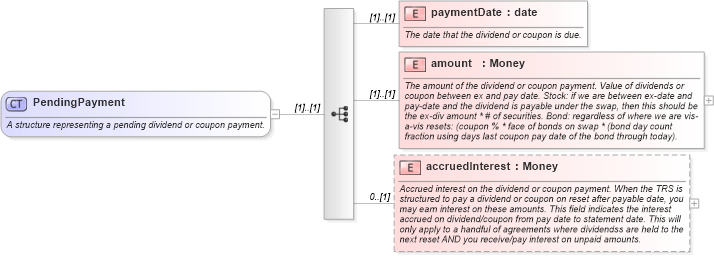

<xsd:complexType name="PendingPayment">

<xsd:annotation>

<xsd:documentation>A structure representing a pending dividend or coupon payment.</xsd:documentation>

</xsd:annotation>

<xsd:sequence>

<xsd:element name="paymentDate" type="xsd:date">

<xsd:annotation>

<xsd:documentation xml:lang="en">The date that the dividend or coupon is due.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="amount" type="Money">

<xsd:annotation>

<xsd:documentation xml:lang="en">The amount of the dividend or coupon payment. Value of dividends or coupon between ex and pay date. Stock: if we are between ex-date and pay-date and the dividend is payable under the swap, then this should be the ex-div amount * # of securities. Bond: regardless of where we are vis-a-vis resets: (coupon % * face of bonds on swap * (bond day count fraction using days last coupon pay date of the bond through today).</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="accruedInterest" type="Money" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Accrued interest on the dividend or coupon payment. When the TRS is structured to pay a dividend or coupon on reset after payable date, you may earn interest on these amounts. This field indicates the interest accrued on dividend/coupon from pay date to statement date. This will only apply to a handful of agreements where dividendss are held to the next reset AND you receive/pay interest on unpaid amounts.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:complexType>

|