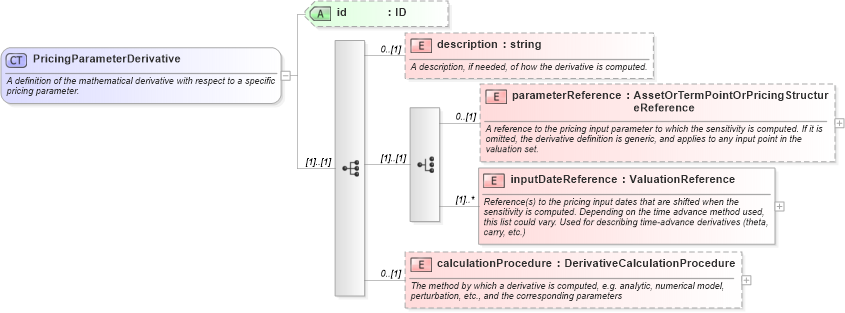

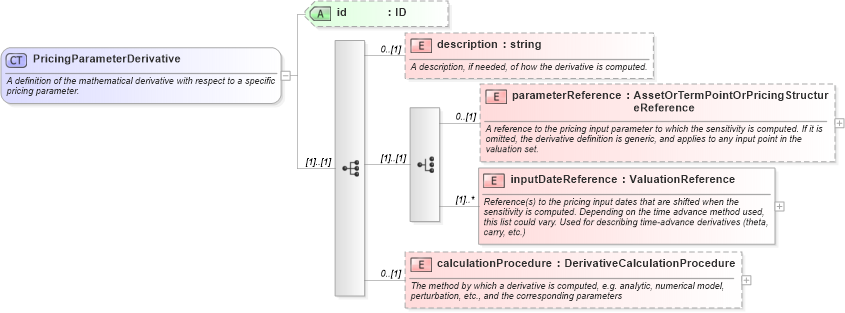

<xsd:complexType name="PricingParameterDerivative">

<xsd:annotation>

<xsd:documentation xml:lang="en">A definition of the mathematical derivative with respect to a specific pricing parameter.</xsd:documentation>

</xsd:annotation>

<xsd:sequence>

<xsd:element name="description" type="xsd:string" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">A description, if needed, of how the derivative is computed.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:choice>

<xsd:element name="parameterReference" type="AssetOrTermPointOrPricingStructureReference" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">A reference to the pricing input parameter to which the sensitivity is computed. If it is omitted, the derivative definition is generic, and applies to any input point in the valuation set.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="inputDateReference" type="ValuationReference" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">Reference(s) to the pricing input dates that are shifted when the sensitivity is computed. Depending on the time advance method used, this list could vary. Used for describing time-advance derivatives (theta, carry, etc.)</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:choice>

<xsd:element name="calculationProcedure" type="DerivativeCalculationProcedure" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">The method by which a derivative is computed, e.g. analytic, numerical model, perturbation, etc., and the corresponding parameters</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

<xsd:attribute name="id" type="xsd:ID" />

</xsd:complexType>

|