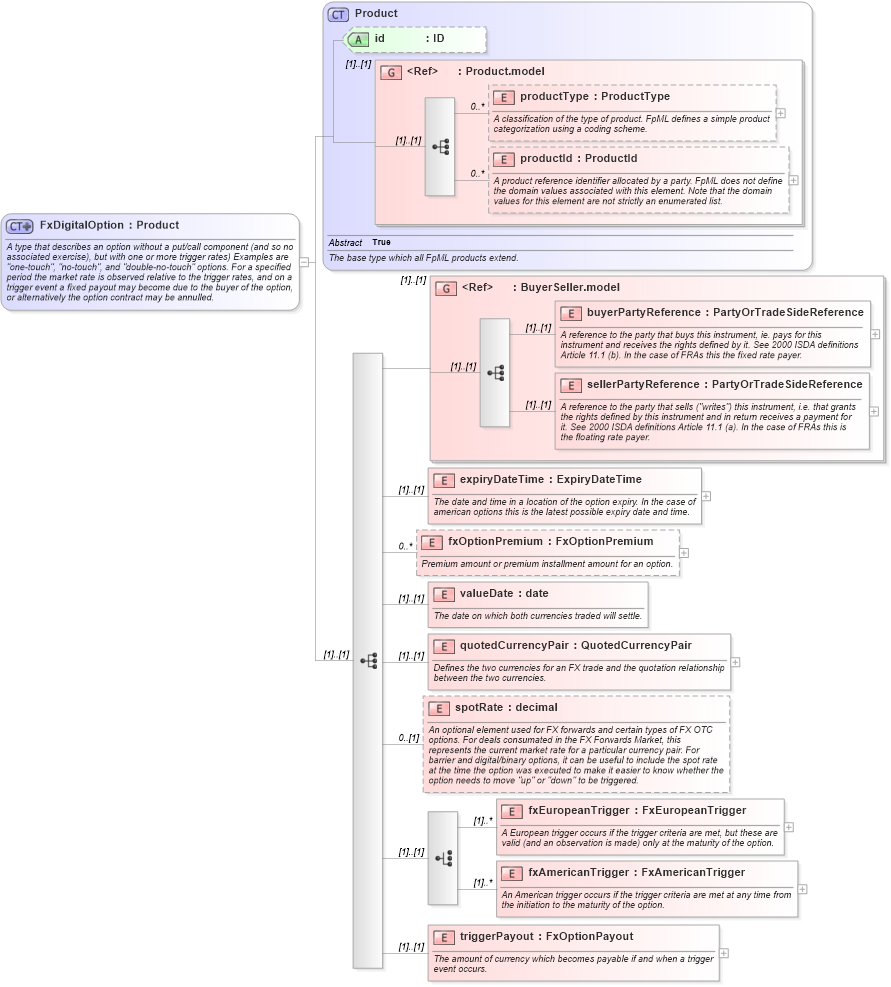

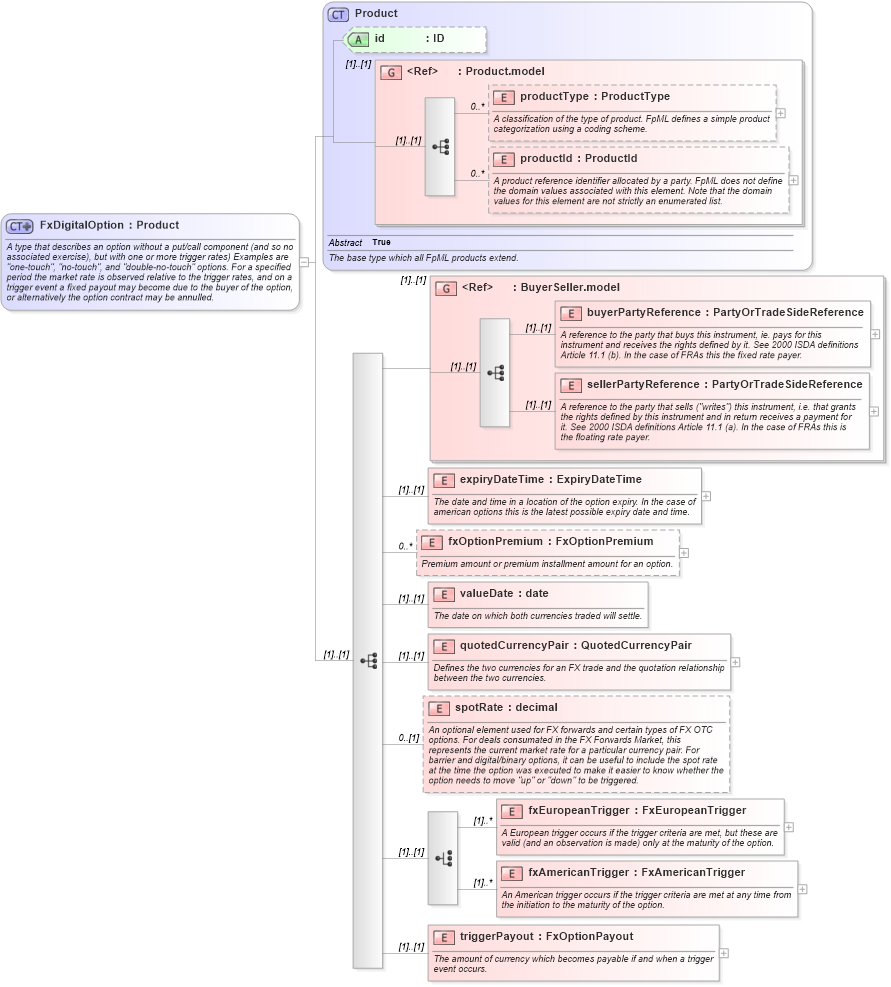

<xsd:complexType name="FxDigitalOption">

<xsd:annotation>

<xsd:documentation xml:lang="en">A type that describes an option without a put/call component (and so no associated exercise), but with one or more trigger rates) Examples are "one-touch", "no-touch", and "double-no-touch" options. For a specified period the market rate is observed relative to the trigger rates, and on a trigger event a fixed payout may become due to the buyer of the option, or alternatively the option contract may be annulled.</xsd:documentation>

</xsd:annotation>

<xsd:complexContent>

<xsd:extension base="Product">

<xsd:sequence>

<xsd:group ref="BuyerSeller.model" />

<xsd:element name="expiryDateTime" type="ExpiryDateTime">

<xsd:annotation>

<xsd:documentation xml:lang="en">The date and time in a location of the option expiry. In the case of american options this is the latest possible expiry date and time.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="fxOptionPremium" type="FxOptionPremium" minOccurs="0" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">Premium amount or premium installment amount for an option.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="valueDate" type="xsd:date">

<xsd:annotation>

<xsd:documentation xml:lang="en">The date on which both currencies traded will settle.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="quotedCurrencyPair" type="QuotedCurrencyPair">

<xsd:annotation>

<xsd:documentation xml:lang="en">Defines the two currencies for an FX trade and the quotation relationship between the two currencies.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="spotRate" type="xsd:decimal" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">An optional element used for FX forwards and certain types of FX OTC options. For deals consumated in the FX Forwards Market, this represents the current market rate for a particular currency pair. For barrier and digital/binary options, it can be useful to include the spot rate at the time the option was executed to make it easier to know whether the option needs to move "up" or "down" to be triggered.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:choice>

<xsd:element name="fxEuropeanTrigger" type="FxEuropeanTrigger" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">A European trigger occurs if the trigger criteria are met, but these are valid (and an observation is made) only at the maturity of the option.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="fxAmericanTrigger" type="FxAmericanTrigger" maxOccurs="unbounded">

<xsd:annotation>

<xsd:documentation xml:lang="en">An American trigger occurs if the trigger criteria are met at any time from the initiation to the maturity of the option.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:choice>

<xsd:element name="triggerPayout" type="FxOptionPayout">

<xsd:annotation>

<xsd:documentation xml:lang="en">The amount of currency which becomes payable if and when a trigger event occurs.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

|