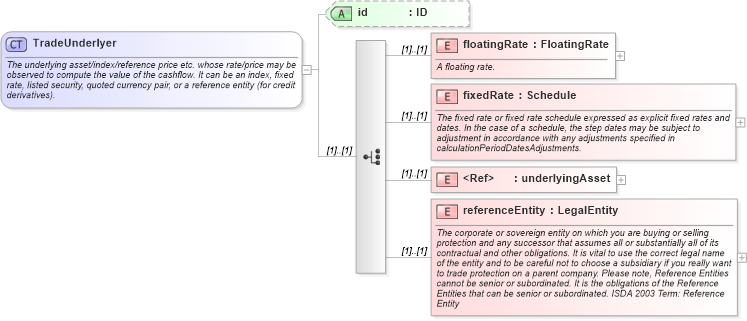

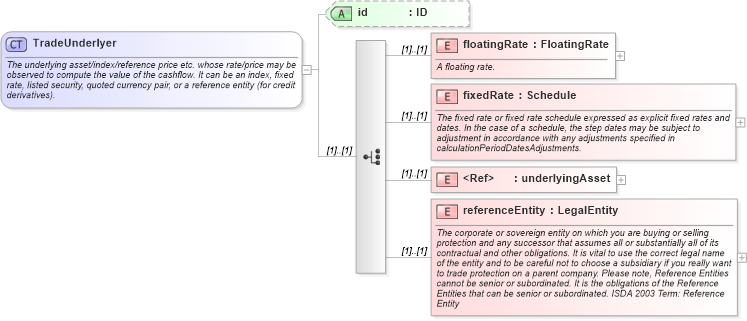

<xsd:complexType name="TradeUnderlyer">

<xsd:annotation>

<xsd:documentation xml:lang="en">The underlying asset/index/reference price etc. whose rate/price may be observed to compute the value of the cashflow. It can be an index, fixed rate, listed security, quoted currency pair, or a reference entity (for credit derivatives).</xsd:documentation>

</xsd:annotation>

<xsd:choice>

<xsd:element name="floatingRate" type="FloatingRate">

<xsd:annotation>

<xsd:documentation xml:lang="en">A floating rate.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="fixedRate" type="Schedule">

<xsd:annotation>

<xsd:documentation xml:lang="en">The fixed rate or fixed rate schedule expressed as explicit fixed rates and dates. In the case of a schedule, the step dates may be subject to adjustment in accordance with any adjustments specified in calculationPeriodDatesAdjustments.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element ref="underlyingAsset">

<xsd:annotation>

<xsd:documentation xml:lang="en">Define the underlying asset when it is a listed security.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="referenceEntity" type="LegalEntity">

<xsd:annotation>

<xsd:documentation xml:lang="en">The corporate or sovereign entity on which you are buying or selling protection and any successor that assumes all or substantially all of its contractual and other obligations. It is vital to use the correct legal name of the entity and to be careful not to choose a subsidiary if you really want to trade protection on a parent company. Please note, Reference Entities cannot be senior or subordinated. It is the obligations of the Reference Entities that can be senior or subordinated. ISDA 2003 Term: Reference Entity</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:choice>

<xsd:attribute name="id" type="xsd:ID" />

</xsd:complexType>

|