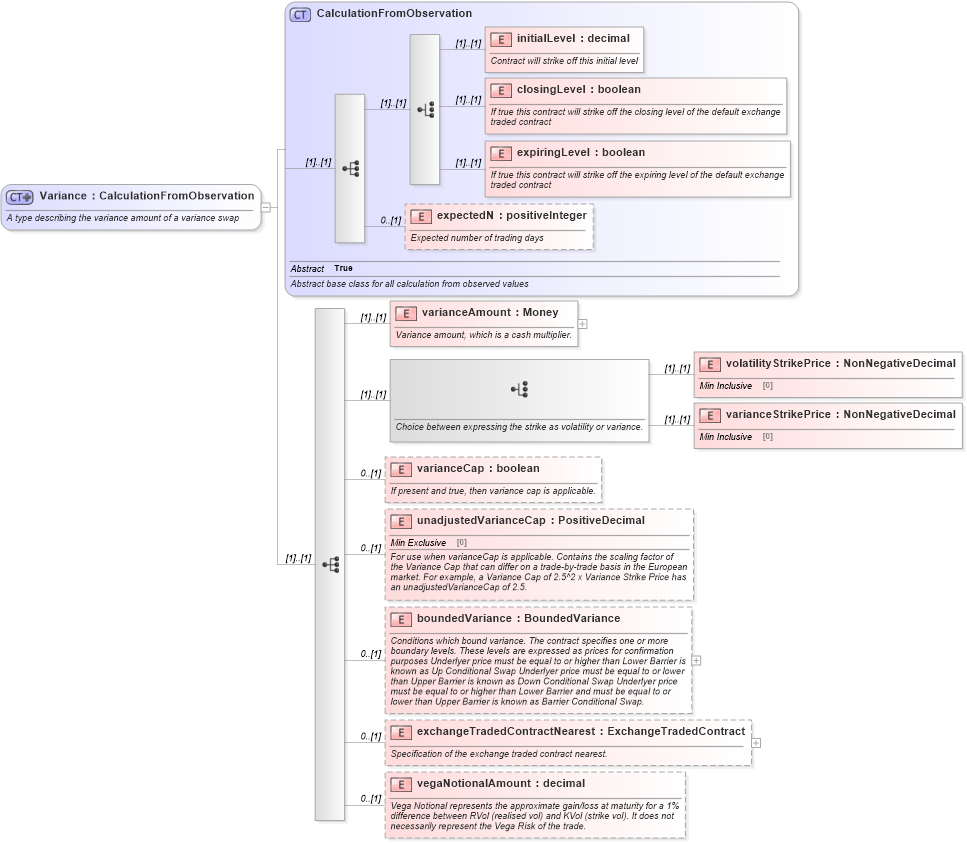

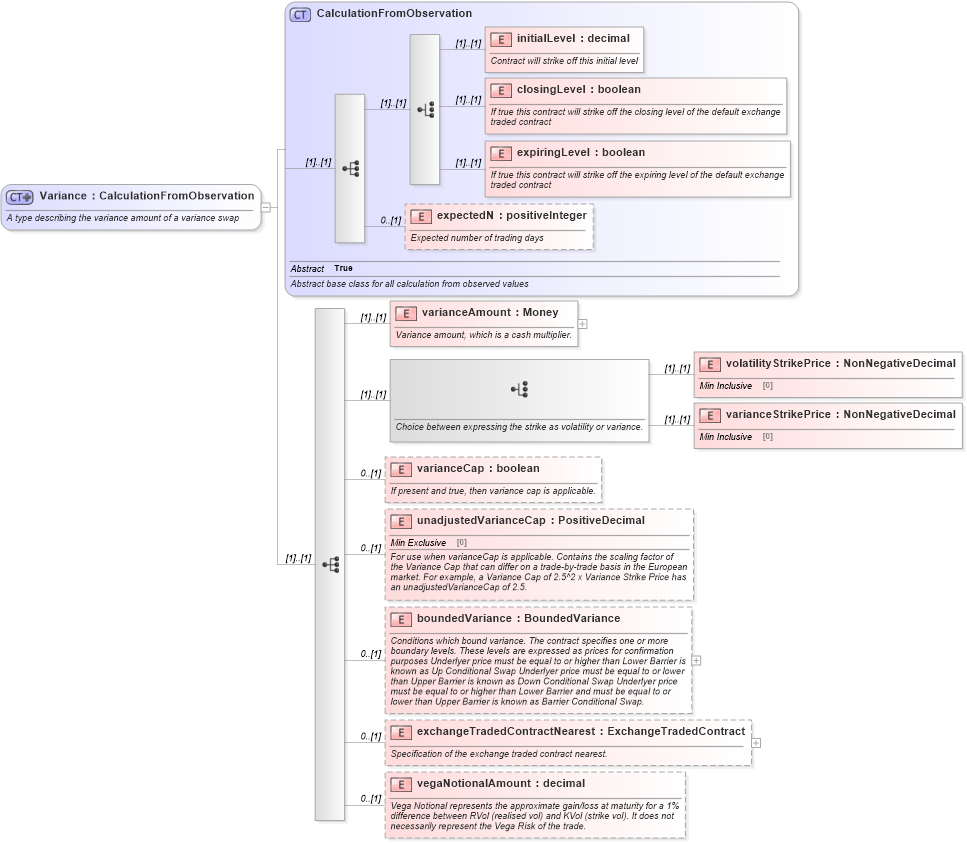

<xsd:complexType name="Variance">

<xsd:annotation>

<xsd:documentation xml:lang="en">A type describing the variance amount of a variance swap</xsd:documentation>

</xsd:annotation>

<xsd:complexContent>

<xsd:extension base="CalculationFromObservation">

<xsd:sequence>

<xsd:element name="varianceAmount" type="Money">

<xsd:annotation>

<xsd:documentation xml:lang="en">Variance amount, which is a cash multiplier.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:choice>

<xsd:annotation>

<xsd:documentation xml:lang="en">Choice between expressing the strike as volatility or variance.</xsd:documentation>

</xsd:annotation>

<xsd:element name="volatilityStrikePrice" type="NonNegativeDecimal" />

<xsd:element name="varianceStrikePrice" type="NonNegativeDecimal" />

</xsd:choice>

<xsd:element name="varianceCap" type="xsd:boolean" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">If present and true, then variance cap is applicable.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="unadjustedVarianceCap" type="PositiveDecimal" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">For use when varianceCap is applicable. Contains the scaling factor of the Variance Cap that can differ on a trade-by-trade basis in the European market. For example, a Variance Cap of 2.5^2 x Variance Strike Price has an unadjustedVarianceCap of 2.5.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="boundedVariance" type="BoundedVariance" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Conditions which bound variance. The contract specifies one or more boundary levels. These levels are expressed as prices for confirmation purposes Underlyer price must be equal to or higher than Lower Barrier is known as Up Conditional Swap Underlyer price must be equal to or lower than Upper Barrier is known as Down Conditional Swap Underlyer price must be equal to or higher than Lower Barrier and must be equal to or lower than Upper Barrier is known as Barrier Conditional Swap.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="exchangeTradedContractNearest" type="ExchangeTradedContract" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Specification of the exchange traded contract nearest.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="vegaNotionalAmount" type="xsd:decimal" minOccurs="0">

<xsd:annotation>

<xsd:documentation xml:lang="en">Vega Notional represents the approximate gain/loss at maturity for a 1% difference between RVol (realised vol) and KVol (strike vol). It does not necessarily represent the Vega Risk of the trade.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

|